By Hammad Aslam, Investor at Susa Ventures

“You can drop a tilapia in the tank, and they all start to behave the same… which is actually pretty similar to VCs with new data technologies.” — The Data Stack Show

As much as I hate to admit it, this statement is not too far from the truth. For all the talk of being contrarian, it usually pays to be part of the consensus. If you see something hot in the market and people you respect are chasing that exciting opportunity, it’s easy to want to do the same. Sometimes that’s the right move and other times it’s not. Regardless of the outcome, the real failure comes from leaving conviction by the wayside, which is often more common with a consensus-driven investing approach.

So you can imagine my concern when in the month of SaaStr 2022, I started hearing multiple folks in the Valley claiming that SaaS investing is “boring”, “overrated”, or just proclaiming that “nothing interesting will come out now”. Admittedly, we are living through some unprecedented times: company building is harder than ever, tech budgets are being re-evaluated, public markets are facing extreme pressure and layoffs are happening. Saying that the macro backdrop does not look good is an understatement!

Sometimes, there is also a tendency among investors to be too focused on short-term outcomes and milestones. This sentiment was exaggerated by the decade-long post-GFC bull run. Valuations only go up and to the right was the mantra, and getting to the next raise was the operating paradigm. Fast forward to today and with the Bessemer Emerging Cloud Index down ~50% since October 2021 and meaningfully lagging the Nasdaq Index, I can understand why some investors are hesitant about software’s prospects in the short-term. Shouldering the weight of aggressive valuations from 2020 and 2021 will be tough and the headwinds to growth potential may pose a serious risk to young SaaS companies, especially as they navigate an uncertain future.

What does this mean for early growth investors like me? Is all hope lost? Are we staring down the Moon Door with no landing in sight?

No. 25+ years into the SaaS revolution, we are just getting started. Enterprise digital transformation is the modern-day equivalent of the industrial revolution, which took ~80 years. Software-driven digitization is an even grander undertaking.

Case in point, at the time of writing, Adobe announced the acquisition of Figma for $20Bn, representing a ~50x ARR forward top-line multiple. In a matter of minutes following the announcement, the VC Twitterverse declared that SaaS is cool again!

As we look towards the next era of company building in enterprise SaaS, let’s align on what the big picture looks like and the principles we should focus on.

The Bigger Picture

Our world will continue to become more complex with every passing year. The first commercial flight happened 110 years ago and today, we have thousands of daily commercial flights, chartered operations, private jets, general aviation, and delivery drones. 15 years ago, Walmart and Target expected customers to walk through the door and buy what they could find on the shelves. Today, I can see the exact inventory at a store and complete my shopping experience without leaving the couch.

It may seem like we are near the end of the bell curve of the complexity that we can create around us. But that’s the curse of hindsight — just because we have come a long way does not mean that we have reached the end of the journey.

Fundamentally, software was created to mitigate complexities across our modern society. As long as we continue to generate these complexities, there will be a need for more robust software platforms. But if the opportunity is there and a lot is still missing, then what’s the next big opportunity? Chris Wanstrath, the founder of GitHub, summed it up perfectly a few years ago:

“The way software is going to change our lives and our society? We don’t even know yet. The way it will change us is going to be nonlinear, and it’s hard for us to make those sorts of leaps”

Accepting this nonlinear uncertainty, let’s brainstorm a framework to rally behind, which can help define what to build and how.

Building a Software Empire — First Principles

We believe that the following five principles are key to building software for an increasingly complex world:

i) Understand the Need

ii) Drive Innovation

iii) Create Tangible Value

iv) Claim a Fair Share, and

v) Long-Term Focus

Principle #1: Understand the Need

This is the most critical element of building a lasting software company and is way more complex than anything we can cover here. Our world has changed. Regardless of the target customers, there is a greater sophistication among customers and a sharper awareness of the evolution of their needs. Gone are the days when generic solutions can cater to nuanced problems. It is simply not enough to say “We are better than the status quo. Use us instead”. The best companies in 20 years will be able to understand and anticipate the evolution of their customers’ needs before the customers themselves can.

We’re in a phase of company building where competition has never been higher. Evolving into an agile organization that is a thought partner for its customers, instead of being a vendor, will drive lasting success. Take the example of Epsilon3, a budding software company building a platform for complex engineering, testing, and operational procedures for space tech organizations. The Epsilon3 team did not wait for customers to come and tell them what platform they needed. Instead, they understood their industry deeply, realized the critical points of failure, and are focused on building a superior product, supported by consistent customer feedback to tailor the broader vision for the specific customer needs. While they are early in their journey, this is the type of product development DNA that will become increasingly crucial in the future.

Principle #2: Drive Innovation

Resting on your laurels after initial success is a recipe for disaster. The traditional convention around company building goes as follows: build a product at seed, reach product-market fit in early growth, scale your GTM in growth and go public. This is too restrictive and frankly, incompatible with the world we are living in. Software companies today need to think of product-market fit as an evolutionary mechanism and not a one-time discrete event. It’s an iterative process that requires continuous and close observation of the market and the product. One pulls the other and vice versa. Sometimes, this requires companies to pull their customers along the path of innovation, and other times, it’s about sharpening the platform based on the trajectory of the market.

As an example, here’s how Airbyte is doing it:

Having this kind of laser-focused approach to pushing the limits through the company’s entire lifecycle will put you at an advantage. No longer are you satisfying the requirements of an RFP or winning because of marginal strength but will instead be crushing the competition by delivering something far more unexpected.

There isn’t any one framework for driving innovation. It can come from increasing depth, expanding breadth, robustness, agility, or simplification. Figuring out the right approach needs to be done on a case-by-case basis.

Principle #3: Create Tangible Value

We can execute perfectly on the first two principles but decisions are made based on the articulation of the value and innovation generated. This is why it is critical to deliver explicit, tangible proof of value to customers on an ongoing basis. Every dollar of software spend is an investment in the reduction of complexity, and the clearer this articulation is, the stronger the resilience of the business. Perception is as important as substance!

This is not a new concept, but certainly, one that often gets overlooked. Tangible ROI can only be achieved by delivering products to customers that meaningfully improve workflows and allows for the measurement of that delta. Let’s look at how Docusign was able to do this with an excerpt from the S-1 filed in 2018:

“T-Mobile wanted all its transactions with customers to be simple. Previously, when customers bought or leased phones, they would need to read and sign more than 50 pages of paper-based documentation. As part of its work with T-Mobile over the past several years, DocuSign has enabled the company to dramatically reduce the volume of documentation. It has also simplified the complexity of completing the agreement. Customers now only have two calls to action rather than 12 prior to adoption of DocuSign’s platform. And with the reduction in the time taken to complete a transaction, in-store closure rates have increased at least 20% since adoption of DocuSign’s platform.”

Customers will demand this level of clarity from their software investments. The immediate impact on the status quo is not enough — DocuSign needed to deliver a higher NPS for T-mobile, better closure rates, and strong customer retention. Makes sense why DocuSign is not just the industry standard but also the verb for electronic signatures!

Principle #4: Claim a Fair Share

All this effort but we have not talked about payday yet. While value creation is important, identifying your share of that value is equally important, especially in the early stages. There are a few different elements at play here:

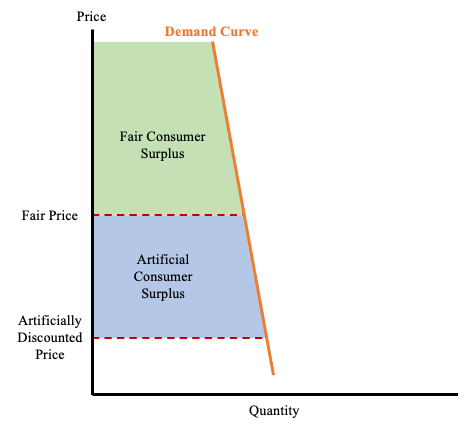

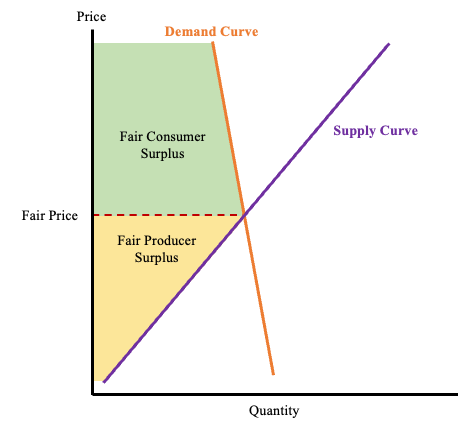

Firstly, the value being created needs to be higher than what the customer is expecting. Otherwise, you will not be able to price the platform fairly to generate a return for your business. For example, if a customer is unwilling to adopt a solution for an ACV of $50k but is open to it at a 50% discount, the perceived value of the solution is not $50k, even if it was developed for that to be the case. By artificially pricing the product this low, you are transferring all the value to the customer as a cost for adoption. This is essentially the same as the economic concept of producer and consumer surplus.

Instead, lasting software companies tend to price their platform fairly from the start. This ensures that from the starting line, both internally and externally, there is a high degree of alignment between the value created for the customer and the associated share of that value owed to the business. This equilibrium can shift over time as both the product and the market evolve, but it’s imperative to not be below this equilibrium at any stage of the building process.

The added benefit of this approach is ensuring customer durability. Strong awareness of tangible ROI and the associated costs from the first phase of a customer relationship translates into higher gross retention, better pricing power, and high customer lifetime value.

Principle #5: Long-Term Focus

Long-term focus requires a lot of foresight and sharp decision-making. Hype cycles are short-dated but generational companies are not. Structural forces will always push businesses towards uncompetitiveness over time. The most successful businesses learn how to adapt to a changing world, knowing how to always be two steps ahead.

Reaching the next round of funding or an arbitrary ARR target should be nothing more than a milestone in the journey. Too many times, companies falter due to a lack of strategic long-term thinking. Failure of a robust vision often manifests as a slow decline: sales cycles lengthen, churn ticks up, product development stalls, or NPS creeps down, but the circuit breakers do not trip until it is too late.

Sometimes, long-term focus is confused with the expectation of outsized outcomes. Targeting outsized outcomes is great but it is not the same as having a long-term focus. Multi-billion dollar outcomes happen because the building blocks are long-lasting and not the other way around. Simply put, large victories happen because of incredible visions and the proper execution of that long-term strategy.

These principles we talked about are not new or revolutionary, but it’s important to keep them in mind amid a challenging market environment. Driving investment theses based on these concepts will drive high conviction and centering company ethos around these goals will give founders the highest win probability.

More than a decade ago, Marc Andreessen said that “software is eating the world”. He was right and after all these years, the statement has not changed. The degrees to which software will continue to eat the world are nearly boundless. The first two innings have been incredible but we have seven more to go!

We love software at Susa, and the sector will continue to be the cornerstone of our investment focus. We’re not looking at short-term market trends or prevailing valuation sentiments, but instead, want to partner with companies focused on these five principles of software building. We invest $1–3MM at seed and $10MM+ in post-seed, early growth rounds. If you are a SaaS founder, reach out to us at hammad@susaventures.com

The Future of Software: Back to the Basics was originally published in Susa Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.